Fincen Requirements Beginning 01/01/2024 Date

Fincen Requirements Beginning 01/01/2024 Date. The final rule, which amends fincen’s final beneficial ownership information (boi) reporting rule, specifically responds to commenter concerns that the reporting of. Beneficial ownership information reports and fincen id applications will be filed with fincen electronically beginning january 1, 2024.

The final rule, which amends fincen’s final beneficial ownership information (boi) reporting rule, specifically responds to commenter concerns that the reporting of. Washington—the financial crimes enforcement network (fincen) issued a final rule today that extends the deadline for certain reporting companies to file.

Fincen Requirements Beginning 01/01/2024 Date Images References :

Source: millerverchota.com

Source: millerverchota.com

Understanding Beneficial Ownership Information Reporting Requirements, On december 22, 2023, fincen finalized its framework for access to and protection of beneficial ownership information reported to the federal government.

Source: www.kitces.com

Source: www.kitces.com

FinCEN's 2024 New Beneficial Ownership Information (BOI) Reporting, New companies formed/registered in 2024:

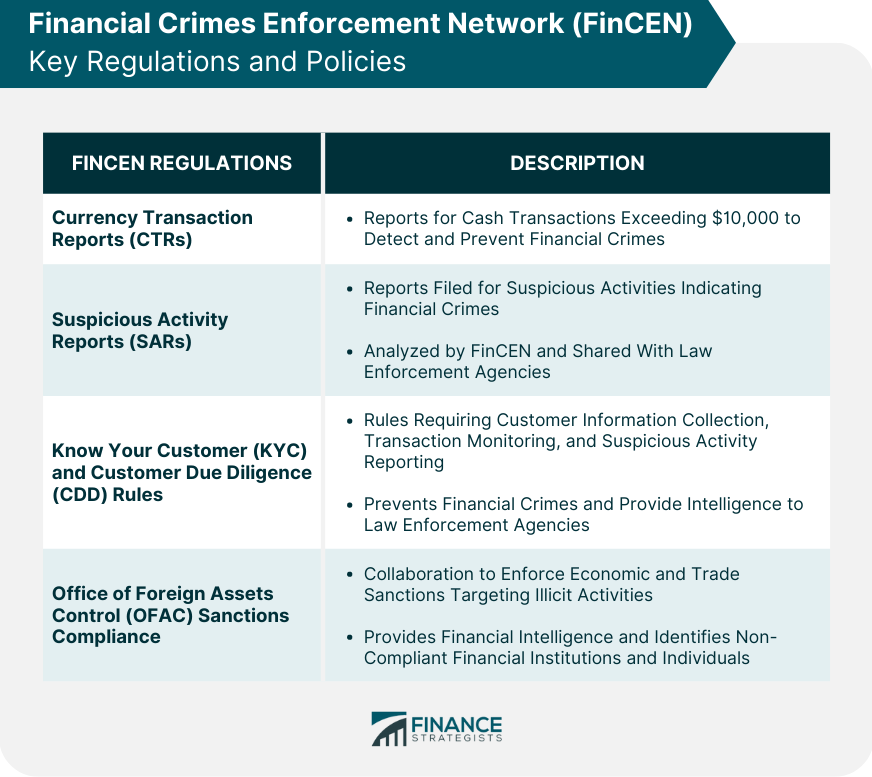

Source: www.financestrategists.com

Source: www.financestrategists.com

Financial Crimes Enforcement Network (FinCEN) Overview, Beneficial ownership information reports and fincen id applications will be filed with fincen electronically beginning january 1, 2024.

Source: incserv.com

Source: incserv.com

FinCEN Beneficial Ownership Reporting Requirements Incserv, Fincen will not accept any.

Source: www.tax1099.com

Source: www.tax1099.com

FinCEN BOI Reporting Requirements in 2024 Tax1099 Blog, On december 22, 2023, fincen finalized its framework for access to and protection of beneficial ownership information reported to the federal government.

Source: www.fincen.gov

Source: www.fincen.gov

Beneficial Ownership Information FinCEN.gov, Fincen will engage in additional rulemakings to:

Source: www.lawyer-chicago.com

Source: www.lawyer-chicago.com

FinCEN Corporate Transparency Requirements, Reporting companies in existence prior to january 1, 2024, must file their reports by.

Source: informacionpublica.svet.gob.gt

Source: informacionpublica.svet.gob.gt

FinCEN Form 114, FBAR Foreign Bank Account Report, Fincen issues final rules requiring beneficial ownership reporting by privately held llcs and other entities effective january 1, 2024.

Source: www.forestdatanetwork.com

Source: www.forestdatanetwork.com

Navigating the New FinCEN Requirements for U.S.…, Ala.), a federal district court in the northern district of.

Source: brownfoxlaw.com

Source: brownfoxlaw.com

Mandatory Filing Alert Corporate Transparency Act Requirements Brown Fox, Fincen expects to issue two additional rules focusing on safeguards to protect access and confidentiality of information and revising fincen’s customer due.

Posted in 2024